Before diving into the mechanics of Forex trading, it’s essential to understand the structure of the market and the key participants involved. The Forex market is a complex and hierarchical system, with different players contributing to its operation and dynamics.

The Forex Hierarchy

At the pinnacle of the Forex market hierarchy are the major global banks, also known as Tier 1 banks. These include institutions such as JPMorgan Chase, Citibank, Deutsche Bank, HSBC, and others. These banks are the primary market makers, responsible for setting the bid and ask prices for currencies. They play a crucial role in determining exchange rates based on supply and demand dynamics. These institutions trade massive volumes of currencies daily, often in the billions of dollars, and their actions significantly influence the Forex market’s movements.

Understanding the positions and activities of these major banks is vital for retail traders, as these institutions drive market trends and the bid/ask spread—the difference between the buying and selling price of a currency pair. One tool that provides insight into the positions of large traders, including banks, is the Commitment of Traders (COT) report, which is published weekly by the Commodity Futures Trading Commission (CFTC). This report offers valuable data on the net positions of different market participants, including commercials, large speculators, and small traders.

Below the Tier 1 banks are the medium-sized and smaller banks, which also engage in Forex trading but at a smaller scale. Following them are hedge funds and corporations that participate in the Forex market for both speculative purposes and to hedge against currency risk. Retail market makers and retail ECNs (Electronic Communication Networks) come next, providing liquidity to the market and facilitating trades for retail traders.

At the base of the hierarchy are retail traders—individuals like us. Retail traders typically access the market through brokers or online trading platforms, and while they trade smaller volumes compared to institutional players, they collectively account for a significant portion of daily trading activity.

Trading Sessions

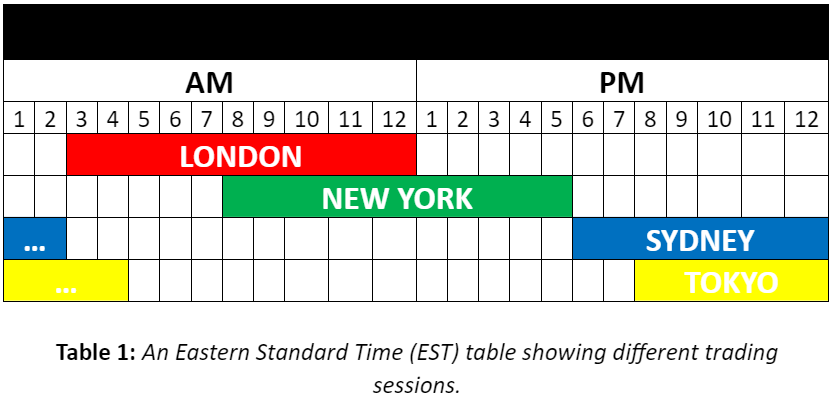

The Forex market operates 24 hours a day, five days a week, but it doesn’t mean that all trading hours are equally active. The market is divided into four major trading sessions, each corresponding to the primary financial centers of the world:

- Sydney Session: ~6:00 PM – 2:00 AM EST

- Tokyo Session: ~8:00 PM – 4:00 AM EST

- London Session: ~3:00 AM – 12:00 PM EST

- New York Session: ~8:00 AM – 5:00 PM EST

These sessions overlap at certain times, creating periods of heightened market activity:

- Tokyo-London Overlap: 3:00 AM – 4:00 AM EST

- London-New York Overlap: 8:00 AM – 12:00 PM EST

During these overlaps, market liquidity is at its peak due to the simultaneous operation of multiple financial centers. The London-New York overlap is particularly notable, as it represents the two largest financial hubs, and the majority of daily trading volume occurs during this period. This overlap is often considered the best time to trade Forex, as price movements are more significant, spreads are tighter, and the potential for profitable trades is higher.

Best Times to Trade

Not all hours in the Forex market offer the same trading opportunities. Understanding when to trade can make a significant difference in your success as a trader:

- Optimal Days: The Forex market is most active from Tuesday to Thursday, as these days typically see the highest trading volumes and liquidity. Mondays may be slower as traders digest news from the weekend, while Fridays can see reduced activity as traders close positions ahead of the weekend.

- Avoid Low-Volume Periods: Certain times of the day experience low trading volume, such as during the Asian session outside of the Tokyo market hours. These periods can result in slower market movements, wider spreads, and less favorable trading conditions. For example, the hours just before the Tokyo session opens and the hours between the New York session close and the Sydney session open are generally quieter.

- Focus on the London Session: The London session is known for its high liquidity and volatility, making it an ideal time for day traders and swing traders. The majority of significant price movements occur during this session, driven by economic data releases and market events in Europe.

Currency Exchange Rate

A currency exchange rate, often referred to as a Forex quote, is a financial metric that specifies the value of one currency in terms of another. It essentially tells you how much of one currency you need to exchange to obtain a unit of another currency. Currency pairs, such as EUR/USD, represent this relationship and are the cornerstone of Forex trading.

Understanding Currency Pairs

In Forex, currencies are always quoted in pairs because every Forex transaction involves the simultaneous buying of one currency and selling of another. For example, consider the following currency quote:

EUR/USD = 1.31367

In this pair:

- EUR (Euro) is the base currency (the first currency in the pair).

- USD (U.S. Dollar) is the quote currency (the second currency in the pair).

The exchange rate indicates how much of the quote currency (USD) is needed to purchase one unit of the base currency (EUR). In the example above, 1 Euro is worth 1.31367 U.S. Dollars.

How Currency Exchange Works

When trading Forex, you’re either buying or selling a currency pair. Here’s how it works:

- Buying (Going Long): If you believe that the Euro will appreciate against the U.S. Dollar, you would buy the EUR/USD pair. In this case, you are purchasing Euros while simultaneously selling U.S. Dollars. You expect that the exchange rate will increase, meaning the Euro strengthens relative to the Dollar. If the exchange rate rises to 1.32000, and you decide to close your position, you would sell the Euros you bought at a higher rate, thus making a profit.

- Selling (Going Short): Conversely, if you anticipate that the Euro will weaken against the U.S. Dollar, you would sell the EUR/USD pair. Here, you’re selling Euros and buying U.S. Dollars. If the exchange rate falls to 1.31000, and you close your position, you would buy back Euros at a lower rate, again potentially earning a profit.

Key Concepts: Going Long and Going Short

- Going Long: When you buy a currency pair, you are “going long.” This means you expect the base currency (EUR in our example) to increase in value relative to the quote currency (USD). For instance, if you buy EUR/USD at 1.31367, you’re anticipating that the Euro will strengthen against the Dollar. If the exchange rate rises, the value of your position increases, allowing you to sell at a profit.

- Going Short: When you sell a currency pair, you are “going short.” In this case, you expect the base currency to decrease in value relative to the quote currency. Using the same example, if you sell EUR/USD at 1.31367, you’re predicting that the Euro will weaken against the Dollar. If the exchange rate falls, you can buy back the Euro at a lower rate, making a profit from the decline.

Practical Implications of Exchange Rates

Exchange rates fluctuate continuously due to various factors such as economic indicators, geopolitical events, central bank policies, and market sentiment. As a trader, understanding these fluctuations and how they impact currency pairs is crucial. Successful trading involves not only predicting the direction of these movements but also managing risk through tools like stop-loss orders and proper leverage.

Moreover, exchange rates affect global trade, investments, and tourism. For instance, a stronger U.S. Dollar makes imports cheaper for Americans but makes U.S. exports more expensive for foreign buyers. Similarly, tourists traveling abroad will find their money goes further if their home currency is strong relative to the destination currency.