Forex quotes always include two prices: the bid and the ask. The bid price is typically lower than the ask price.

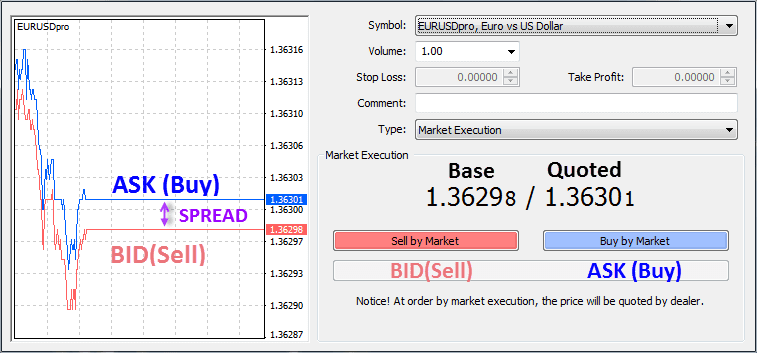

Figure 1: Bid and Ask prices as seen on a real screen.

In forex trading, understanding the concepts of the Bid, Ask, and Spread is crucial for any trader. These terms are fundamental to executing trades and managing costs effectively. Let’s break down each term and explain them with examples.

1. The Bid Price

The bid price is the highest price that a buyer (or the market) is willing to pay for a currency pair at a given moment. In simple terms, if you want to sell a currency pair, you would do so at the bid price.

Example: Let’s say you’re looking at the EUR/USD currency pair on your trading platform, and the bid price is quoted as 1.3629. This means that if you want to sell EUR/USD, the market is willing to buy it from you at the rate of 1.3629. So, for every euro you sell, you will receive 1.3629 U.S. dollars.

2. The Ask Price

The ask price, also known as the offer price, is the lowest price at which a seller (or the market) is willing to sell a currency pair. If you want to buy a currency pair, you would do so at the ask price.

Example: Continuing with the EUR/USD example, the ask price might be quoted as 1.3630. This means that if you want to buy EUR/USD, you will have to pay 1.3630 U.S. dollars for each euro. So, if you decide to buy EUR/USD, you will purchase it at the rate of 1.3630.

3. The Spread

The spread is the difference between the bid price and the ask price. It represents the cost of trading and is how brokers typically make their money. The spread is usually measured in pips, which are the smallest units of price movement in forex trading.

Example: Let’s revisit the EUR/USD example, where the bid price is 1.3629 and the ask price is 1.3630. The spread would be:

$$\text{Spread} = \text{Ask Price} – \text{Bid Price}$$

$$\text{Spread} = 1.3630 – 1.3629 = 0.0001 \text{ (or 1 pip)}$$

In this case, the spread is 1 pip. This means that the cost of entering the trade (whether buying or selling) is 1 pip. So, if you buy EUR/USD at 1.3630, the price needs to increase by 1 pip (to 1.3631) just to cover the spread and reach the break-even point.

Why Is the Spread Important?

- Trading Costs: The spread directly affects your trading costs. A wider spread means higher costs, while a narrower spread means lower costs. This is why traders often prefer to trade during times of high market liquidity, such as during the overlap of major trading sessions (e.g., the London and New York sessions), when spreads tend to be narrower.

- Market Conditions: The spread can also indicate market conditions. During periods of high volatility, spreads may widen as brokers account for increased risk. Conversely, during periods of low volatility or high liquidity, spreads may narrow.

An Expanded Example:

Imagine you are a trader focusing on the GBP/USD pair. You see the following prices on your trading platform:

- Bid Price: 1.3900

- Ask Price: 1.3905

The spread here is 5 pips (1.3905 – 1.3900).

- If you decide to buy GBP/USD, you will enter the market at the ask price of 1.3905.

- If the market price increases and you decide to sell the GBP/USD when the bid price reaches 1.3920, your profit would be calculated as:

$$\text{Profit in Pips} = \text{Selling Price (Bid)} – \text{Buying Price (Ask)}$$

$$\text{Profit in Pips} = 1.3920 – 1.3905 = 15 \text{ pips}$$

Now, multiply this by your lot size to get the actual profit in your account.

However, if the bid price only moves to 1.3905, you would break even, as this movement only covers the spread.

Key Points to Remember:

- Spreads vary: Spreads can vary significantly depending on the currency pair, time of day, market conditions, and the broker’s policies.

- Spread as a trading cost: Always consider the spread as a trading cost when planning your trades, especially for scalpers or day traders who enter and exit trades frequently.

Understanding the bid, ask, and spread is essential to making informed trading decisions and managing the inherent costs of forex trading.