As you become more familiar with charts and market behavior, you’ll quickly realize that trends don’t last forever. At some point, the market will shift, and this shift can take the form of either a retracement or a reversal. Understanding the difference between these two is crucial for any trader, as it allows you to distinguish between temporary pauses in the trend and significant changes in market direction. By making this distinction, you can better interpret market movements, optimize your entry and exit points, and ultimately enhance your trading strategy.

Understanding Retracements and Reversals

Let’s begin by clearly defining the two concepts.

- Retracement: A retracement is a temporary, short-term movement against the prevailing trend. It is a minor pullback that occurs as the market takes a “breather” before resuming its overall direction. Retracements are a natural part of market behavior and often provide opportunities for traders to enter the market at a more favorable price in the direction of the prevailing trend.

- Reversal: A reversal, on the other hand, is a more significant and lasting change in the market direction. It marks the end of the current trend and the beginning of a new one. Reversals indicate a shift in market sentiment, where the forces that were driving the trend weaken and the opposite forces take control, leading to a sustained movement in the new direction.

Figure 1: A sketch illustrating the difference between a retracement and a reversal.

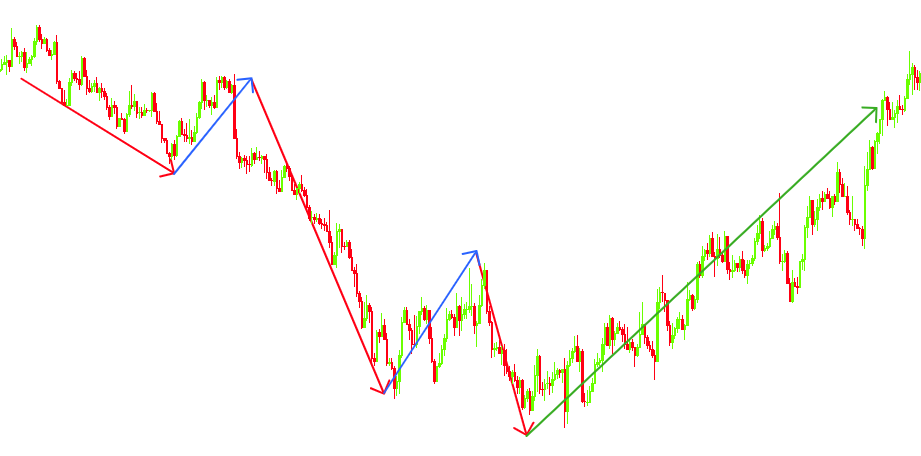

Now, let’s see this on a real chart:

Figure 2: A real chart example showing the distinction between a retracement and a reversal.

Key Differences Between Retracements and Reversals

To further clarify, let’s explore the characteristics that distinguish retracements from reversals:

- In an Uptrend:

- A retracement is a downward movement that does not break the previous low. The price pulls back but remains above the last higher low, indicating that the overall uptrend is still intact.

- A reversal occurs when the price moves downward and breaks below the previous low. This break indicates that the upward momentum has weakened significantly, and a new downtrend may be forming.

- In a Downtrend:

- A retracement is an upward movement that does not surpass the previous high. The price pulls back but stays below the last lower high, suggesting that the overall downtrend is still in play.

- A reversal takes place when the price moves upward and breaks above the previous high, signaling that the downward trend has lost strength and an uptrend may be emerging.

Figure 3: A real chart example showing the distinction between a retracement and a reversal for a market in a downtrend.

The Dilemma: Is It a Retracement or a Reversal?

One of the most common challenges traders face is determining whether a price movement is a retracement or the beginning of a reversal. This decision is crucial because it can significantly impact your trading strategy. If you mistakenly identify a retracement as a reversal, you might exit a profitable position prematurely or miss out on the continuation of a trend. Conversely, if you misinterpret a reversal as a retracement, you could hold onto a losing position for too long, leading to unnecessary losses.

Unfortunately, there’s no foolproof method to predict with absolute certainty whether a retracement or reversal will occur. However, several tools and techniques can help you make a more informed decision:

- Fibonacci Retracement Tool: One of the most popular tools for identifying potential retracement levels is the Fibonacci Retracement tool. This tool uses key Fibonacci ratios (such as 38.2%, 50%, and 61.8%) to identify possible levels where the price might reverse or continue in the direction of the trend. These levels often act as support or resistance, providing clues about whether the price will continue retracing or start reversing.

- Trendlines: Drawing trendlines on your charts can help you identify the point at which a retracement might turn into a reversal. If the price breaks a well-established trendline, it could be an early indication of a reversal.

- Moving Averages: Moving averages, particularly longer-term ones, can help you identify the overall trend direction and provide dynamic support and resistance levels. A price crossing below a long-term moving average in an uptrend or above it in a downtrend can signal a potential reversal.

- Volume Analysis: Analyzing trading volume can also offer insights. In a retracement, volume tends to decrease as the price moves against the trend, while in a reversal, there is often an increase in volume as new participants enter the market in the opposite direction.

- Divergence in Oscillators: Indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help identify divergences. If the price is making new highs or lows but the oscillator is not, it might signal a potential reversal rather than a retracement.

We will go into more detail regarding these tools later on in this course.

Understanding the difference between retracements and reversals is a foundational skill for traders. By recognizing the signs of each, you can make more informed trading decisions, manage your risk better, and improve your overall market analysis. While it may not always be possible to predict with certainty whether a retracement or reversal will occur, using the tools and techniques discussed above can significantly increase your chances of making the right call. As you gain more experience and become more attuned to market behavior, your ability to distinguish between these two market phenomena will improve, giving you a valuable edge in your trading endeavors.