Now that you’ve gained a solid understanding of various concepts related to lines in Forex trading—such as trend lines, channels, and support and resistance levels—it’s time to explore how to effectively use these concepts in your trading strategy. Mastering the art of trading these lines is crucial, as it provides a structured approach to making informed trading decisions. In this section, we will focus on two fundamental concepts that form the basis of many trading strategies: The Bounce and The Break. These concepts describe different methods of entering a trade, each with its own set of rules, risks, and rewards.

The Bounce

The Bounce is a trading strategy that involves entering a trade after the price tests and respects a support or resistance level. The idea behind this method is to wait for the price to approach a significant support or resistance level and then observe how it reacts. If the level holds and the price reverses direction, it signals a potential trading opportunity.

However, instead of placing your trade directly on the support or resistance level as soon as the price touches it, a more cautious approach is to wait for confirmation. This involves letting the price retest the level and begin to reverse before placing your order. By doing so, you allow the market some “breathing room” and increase the likelihood that the level will hold, reducing the chances of getting stopped out by a false breakout.

Figure 1: Trading the bounce from support and resistance.

This method also helps avoid the frustration of entering a trade too early, only to watch the price initially move against you before eventually going in your favor. The key to successfully trading the bounce lies in patience and confirmation.

Example: Trading the Bounce from support

Imagine you’re observing a market in an uptrend. The price approaches a well-established support level, briefly touches it, and then starts to reverse upwards. This is your cue to consider entering a long trade, as the support level has proven to be reliable. By waiting for the initial bounce, you increase the probability of a successful trade.

Figure 2: Trading the bounce from support.

Example: Trading the Bounce from resistance

Conversely, if the market is in a downtrend and the price approaches a resistance level, touches it, and then reverses downwards, this signals a potential short trade. Again, waiting for confirmation before entering the trade can help you avoid false signals.

Figure 3: Trading the bounce from resistance.

The Break

While support and resistance levels often hold, they don’t last forever. There will be times when these levels are broken, leading to significant market movements. The Break strategy involves trading these breakouts, and there are two primary ways to approach this: the aggressive method and the conservative method.

The Aggressive Way

The aggressive entry method involves entering a trade immediately after the price breaks through a support or resistance level. This approach is based on the assumption that once a level is broken, the price will continue to move in the direction of the breakout.

This method is particularly effective when the price breaks through a level with strong momentum, indicating a clear shift in market sentiment. However, it’s essential to be cautious when using this method, as breakouts can sometimes be false, leading to quick reversals that may result in losses.

Figure 4: Trading the break aggressively for a market moving up or down.

Example: Aggressive Entry on a Downtrend Break

Suppose the market is in a downtrend, and the price breaks through a support level with considerable force. An aggressive trader might immediately enter a short position, anticipating that the downward momentum will continue.

Figure 5: Trading the break aggressively after support gets broken.

Example: Aggressive Entry on an Uptrend Break

Similarly, if the price breaks through a resistance level in an uptrend, an aggressive trader would enter a long position, expecting the uptrend to accelerate.

Figure 6: Trading the break aggressively after resistance gets broken.

The Conservative Way

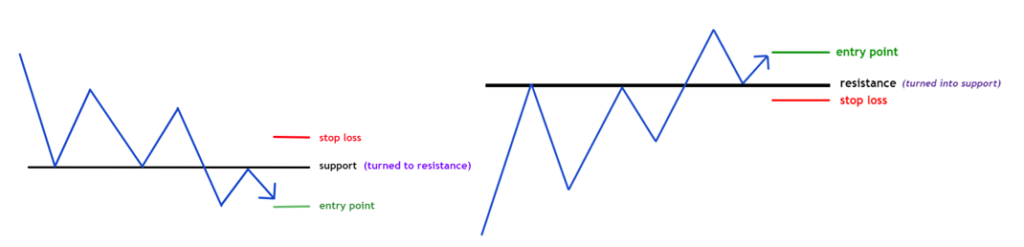

The conservative entry method takes a more cautious approach by waiting for the price to retest the broken support or resistance level before entering a trade. This method capitalizes on the tendency of broken support levels to turn into resistance and broken resistance levels to turn into support. By waiting for the retest, you increase the likelihood that the breakout is genuine and not just a false move.

While this approach reduces the chances of getting caught in a false breakout, it also means that you might miss out on some of the initial momentum of the move. Nonetheless, the conservative method is often favored by traders who prioritize safety and higher probability setups over potential profits.

Figure 7: Trading conservatively for markets that break support or resistance.

Example: Conservative Entry after the break of support

Imagine the price breaks through a support level and then starts to retrace back towards it. A conservative trader would wait for the price to touch the former support (now resistance) and then show signs of continuing downwards before entering a short trade.

Figure 8: Conservative entry after the break of support.

Example: Conservative Entry after the break of resistance

In an uptrend, if the price breaks through a resistance level and then pulls back towards it, a conservative trader would wait for the price to test the former resistance (now support) and then confirm a continuation of the uptrend before entering a long trade.

Figure 9: Conservative entry after the break of resistance.

Key Considerations

Both the aggressive and conservative methods have their advantages and disadvantages, and choosing which one to use depends on your trading style, risk tolerance, and market conditions.

- Aggressive Trading: The main advantage of the aggressive method is the potential to capture more pips if the breakout is strong and sustained. However, the downside is the higher risk of entering a false breakout, leading to quick losses.

- Conservative Trading: The conservative method’s primary advantage is the increased likelihood of entering a trade with higher statistical odds of success, as the retest offers additional confirmation. The trade-off is that you may miss out on some of the initial moves, resulting in fewer opportunities.

Trading the lines, whether through the bounce or the break, is a fundamental skill that every Forex trader should master. These methods provide clear guidelines for entering and exiting trades, helping you navigate the often unpredictable world of Forex with greater confidence.

As you develop your trading strategy, remember that no method is foolproof. Combining these techniques with other forms of analysis, such as trend indicators, oscillators, or volume analysis, can help you make more informed decisions. Above all, practice and experience will refine your ability to identify the best opportunities, whether you’re trading the bounce, the break, or a combination of both.