Elliott Waves are a popular technical analysis tool used to predict future price movements in financial markets. Developed by Ralph Nelson Elliott, an American accountant, in the 1930s, this theory is based on the idea that markets move in repetitive, wave-like patterns driven by investor psychology. Elliott observed that these patterns, or “waves,” repeat themselves in recognizable sequences, which he believed were a reflection of the collective mood of market participants. According to Elliott, these waves can help traders anticipate future price movements and make more informed trading decisions.

The 5-3 Wave Pattern

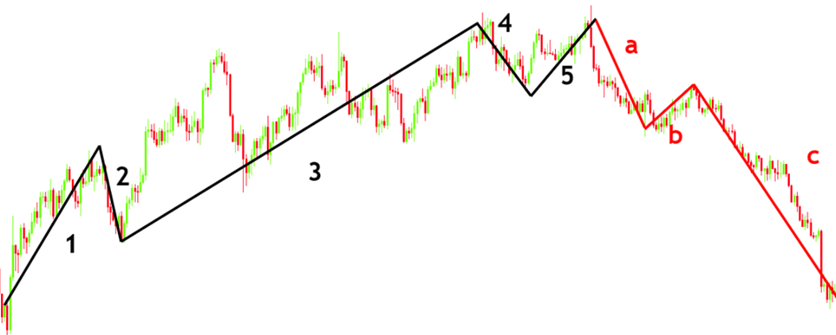

The cornerstone of Elliott Wave Theory is the 5-3 wave pattern, which consists of two distinct phases: the impulsive phase and the corrective phase.

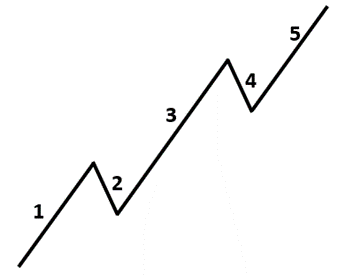

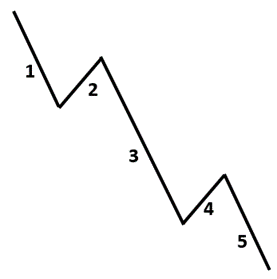

- Impulsive Phase (5 Waves): The first phase consists of five waves that move in the direction of the prevailing trend, whether it is up or down. These waves are labelled as 1, 2, 3, 4, and 5:

- Wave 1: This is the initial move in the direction of the trend. It often catches the market by surprise as it signals the beginning of a new trend.

- Wave 2: This wave retraces a portion of Wave 1. It is a corrective wave, meaning it moves against the trend, but it never retraces the entirety of Wave 1.

- Wave 3: This is usually the strongest and longest wave of the five. It moves in the direction of the trend and often exceeds the length of Wave 1. Wave 3 typically has the most significant price movement as more traders become aware of the new trend.

- Wave 4: Another corrective wave that moves against the trend. It usually retraces a smaller portion of Wave 3 and is less volatile compared to Wave 2.

- Wave 5: The final impulsive wave in the sequence. It usually has less momentum than Wave 3 but still moves in the direction of the overall trend. After Wave 5 completes, the market is generally considered overbought or oversold, leading to a reversal.

Figure: An uptrend 5-wave pattern.

Figure: A downtrend 5-wave pattern.

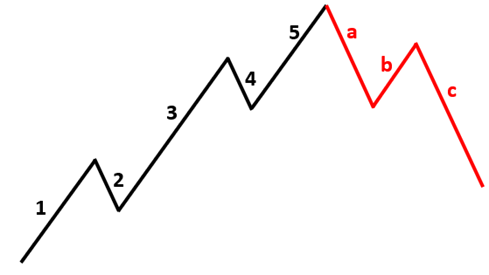

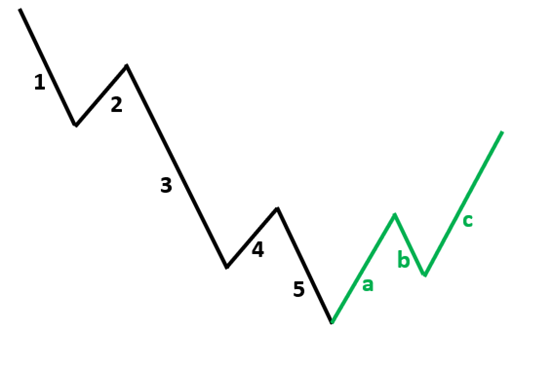

- Corrective Phase (3 Waves): After the impulsive phase, the market enters the corrective phase, which consists of three waves labeled A, B, and C:

- Wave A: The first wave of the corrective phase that moves against the prevailing trend established in the impulsive phase. Traders often mistake this for the start of a new trend.

- Wave B: This wave is a temporary reversal in the direction of the previous trend. It often creates confusion as it can resemble a continuation of the previous trend.

- Wave C: The final wave of the corrective phase. It moves in the direction of Wave A and completes the correction. This wave typically has strong momentum and is comparable to Wave A in length and strength.

Figure: ABC correction after an uptrend 5-wave pattern.

Figure: ABC correction after a downtrend 5-wave pattern.

Key Principles of Elliott Wave Theory

To effectively use Elliott Wave Theory, it’s important to understand some essential guidelines that govern the wave structure:

- Wave 2 Cannot Retrace 100% of Wave 1: Wave 2 is a corrective wave and should only retrace a portion of Wave 1. If Wave 2 retraces 100% or more of Wave 1, it invalidates the wave count, and the current wave structure needs to be reassessed.

- Wave 3 Cannot Be the Shortest Impulsive Wave: Among Waves 1, 3, and 5, Wave 3 should not be the shortest. It is typically the longest and most powerful wave in the pattern, driven by strong market momentum and increased investor participation.

- Wave 4 Should Not Overlap Wave 1: The price action of Wave 4 should not enter the territory of Wave 1. This rule ensures the integrity of the impulsive wave structure and differentiates it from overlapping corrective patterns.

- Fibonacci Relationships: Elliott Wave Theory often incorporates Fibonacci retracement and extension levels to predict the extent of each wave. For example, Wave 2 often retraces about 50% to 61.8% of Wave 1, while Wave 4 typically retraces 38.2% to 50% of Wave 3. Similarly, Wave 5 can often extend to 61.8% or 100% of the length of Wave 1 or 3.

Combining Elliott Wave Theory with Other Technical Analysis Tools

Elliott Wave Theory becomes even more powerful when combined with other technical analysis tools. By using indicators such as the Relative Strength Index (RSI), Moving Averages, and Fibonacci levels, traders can gain a better understanding of market conditions and identify high-probability trading opportunities.

- Relative Strength Index (RSI): The RSI can help confirm the strength of the waves and identify potential reversal points. For example, if Wave 3 is accompanied by a high RSI reading, it suggests strong momentum and validates the wave count.

- Moving Averages: Moving averages can act as dynamic support and resistance levels, helping traders confirm the trend direction and identify potential entry or exit points based on Elliott Wave analysis.

- Fibonacci Levels: Fibonacci retracement and extension levels are often used to predict the extent of corrective waves and potential price targets for impulsive waves. For example, Wave 2 and Wave 4 corrections often find support or resistance at key Fibonacci retracement levels, such as 38.2%, 50%, or 61.8%.

Practical Application of Elliott Wave Theory

Successfully applying Elliott Wave Theory requires practice, patience, and a thorough understanding of market dynamics. Here are some tips to enhance your ability to utilize this powerful tool:

- Practice Identifying Waves: Study historical charts and practice identifying Elliott Waves in various market conditions. This will help you become more proficient at recognizing wave patterns in real-time.

- Use Multiple Timeframes: Analyzing different timeframes can provide a more comprehensive view of market trends and wave structures. For example, a corrective phase on a daily chart may appear as an impulsive phase on a shorter timeframe.

- Stay Flexible: Elliott Wave Theory is subjective and requires a flexible approach. Be prepared to adjust your wave count as new price data emerges. It’s important to remain open to alternative scenarios and not become overly attached to a particular wave count.

- Risk Management: As with any trading strategy, proper risk management is crucial when using Elliott Wave Theory. Use stop-loss orders to protect your capital and manage your position sizes according to your risk tolerance.

Trading Elliott Waves

Trading Elliott Waves effectively hinges on accurately identifying the current phase of the wave pattern and applying the core rules and principles of the theory. While this might sound straightforward in theory, it requires practice, experience, and a keen eye for detail to successfully spot and interpret these patterns on real-time charts.

Elliott Waves offer a structured approach to understanding market trends by categorizing price movements into predictable waves. The challenge lies in determining which wave phase the market is currently in and anticipating the next move. With practice, traders can develop the ability to distinguish between impulsive and corrective phases and use this knowledge to make informed trading decisions.

Identifying the Wave Phase

To trade Elliott Waves effectively, start by identifying the overall trend of the market. This involves looking for signs of the beginning of an impulsive wave or the end of a corrective wave. The five-wave impulsive pattern generally indicates the direction of the market trend, while the three-wave corrective pattern signals a potential reversal or continuation of the trend.

- Analyze Historical Price Movements: Begin by analyzing past price action to identify clear impulsive and corrective waves. This historical context helps set the stage for understanding the current market phase. By examining previous Elliott Wave patterns, you can better anticipate future movements.

- Look for Wave Characteristics: Pay attention to the specific characteristics of each wave. For example, Wave 3 is typically the longest and strongest, while Wave 4 should not overlap with the price territory of Wave 1. Corrective waves (2 and 4) often retrace a portion of the previous impulsive waves and are usually less volatile.

- Use Multiple Timeframes: Analyzing multiple timeframes can provide a more comprehensive view of the market’s wave structure. A corrective pattern on a daily chart might be an impulsive wave on a shorter timeframe, allowing you to refine your entry and exit points.

- Apply Fibonacci Ratios: Fibonacci retracement and extension levels are valuable tools for identifying potential reversal points and measuring the extent of corrective waves. By aligning Fibonacci levels with Elliott Wave patterns, traders can set more accurate profit targets and stop-loss levels.

Practical Application of Elliott Wave Theory

Once you have identified the current wave phase, the next step is to apply Elliott Wave principles to your trading strategy. Here’s how you can leverage Elliott Waves for trading decisions:

- Trade with the Trend: During the impulsive phase, aim to trade in the direction of the overall trend. If you identify that the market is in Wave 1, 3, or 5, focus on taking long positions in an uptrend or short positions in a downtrend.

- Prepare for Corrections: When the market enters a corrective phase (Wave 2 or 4), be cautious and consider reducing position sizes or using tighter stop-loss levels. Corrections can be unpredictable, and it’s essential to protect your capital during these phases.

- Enter at Key Levels: For both impulsive and corrective phases, look for entry opportunities at key support and resistance levels. These levels often align with Fibonacci retracement or extension points, providing a higher probability of a successful trade.

- Use Confirmation Signals: To increase the reliability of your trades, use additional technical indicators such as moving averages, RSI, or MACD to confirm Elliott Wave patterns. This can help filter out false signals and improve your trading accuracy.

Real-World Examples of Elliott Wave Trading

To illustrate how Elliott Wave Theory can be applied in real-world trading scenarios, let’s look at a couple of examples:

Figure: A real-chart example showing the ABC correction after an uptrend 5-wave pattern.

In this example, we can see an uptrend characterized by a clear five-wave impulsive pattern. After the completion of Wave 5, the market enters a corrective phase with three waves labeled A, B, and C. Traders who recognize the end of Wave 5 and the beginning of Wave A can anticipate a reversal and prepare to trade the correction.

Figure: A real-chart example showing the ABC correction after a downtrend 5-wave pattern.

Here, the market displays a downtrend with a five-wave impulsive pattern, followed by an ABC corrective pattern. By identifying the completion of Wave 5 and the start of Wave A, traders can capitalize on the ensuing correction by positioning themselves for a potential reversal or continuation of the trend.

Important Considerations

While Elliott Wave Theory can be a powerful tool, it’s important to remember a few key points:

- Subjectivity: Elliott Wave analysis can be somewhat subjective, as different traders might interpret the same chart differently. It’s crucial to practice and refine your skills to develop a consistent and reliable approach.

- Complex Corrections: Not all corrections are straightforward ABC patterns. Sometimes, the market forms more complex corrections, such as double or triple threes, which require a deeper understanding of the theory.

- Risk Management: As with any trading strategy, proper risk management is essential when trading Elliott Waves. Always use stop-loss orders and avoid over-leveraging your positions to protect against unexpected market movements.

By mastering the art of identifying Elliott Wave patterns and applying these principles to your trading strategy, you can gain a deeper understanding of market dynamics and improve your ability to predict future price movements. With practice, patience, and a disciplined approach, Elliott Wave Theory can become a valuable tool in your trading arsenal.