Fibonacci levels are essential tools in technical analysis, frequently used to identify potential areas of support and resistance on a price chart. These levels are derived from a mathematical sequence introduced by the Italian mathematician Leonardo Fibonacci. While you don’t need to know how to calculate these levels manually, understanding how to apply them effectively in trading is crucial. Fibonacci levels are categorized into two primary types: Fibonacci Retracement Levels and Fibonacci Extension Levels.

Understanding Fibonacci Levels

The Fibonacci Retracement Levels are 0.236, 0.382, 0.500, 0.618, and 0.764. These levels represent potential points where the price could reverse or pause as it retraces a portion of the previous move. In contrast, Fibonacci Extension Levels include 0, 0.382, 0.618, 1.000, 1.382, and 1.618, which are used to identify potential areas for taking profits when the price moves in the direction of the trend beyond the previous high or low.

So, what do these numbers mean? In trading, these Fibonacci percentages represent potential support and resistance areas. Traders often look for price reactions at these levels, such as reversals or consolidations, which can provide trading opportunities. Combining Fibonacci levels with other technical analysis tools can significantly increase their effectiveness.

Using Fibonacci Levels in Trading

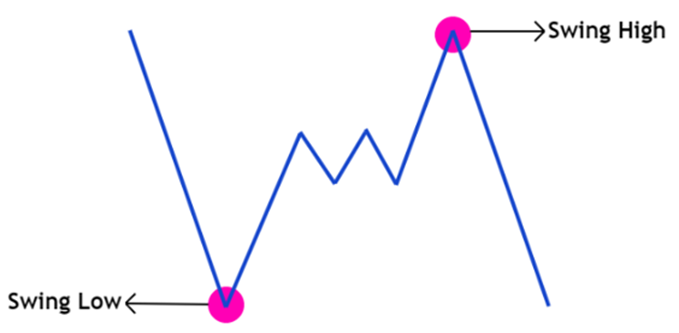

Most charting software comes with a built-in Fibonacci tool, making it easy for traders to plot these levels on their charts. To use the Fibonacci tool effectively, you need to identify the recent significant Swing Highs and Swing Lows on the chart.

- A Swing High is a peak reached by the price before it starts falling.

- A Swing Low is a trough reached by the price before it starts rising.

Figure: A sketch showing major swing lows and swing highs.

Fibonacci Retracement Levels

As mentioned earlier, Fibonacci retracement levels are horizontal lines on a chart that indicate areas of potential support and resistance. These levels can be particularly useful in identifying where price pullbacks might reverse and continue in the direction of the prevailing trend.

To apply the Fibonacci tool, first identify the market trend and the recent major swing levels:

- In an uptrend: Click on the recent Swing Low and drag the cursor to the most recent Swing High. The Fibonacci retracement levels will then plot as potential areas of support where the price might retrace before continuing higher.

- In a downtrend: Click on the recent Swing High and drag the cursor to the most recent Swing Low. The Fibonacci retracement levels will then plot as potential areas of resistance where the price might retrace before continuing lower.

Fibonacci Retracements in an Uptrend

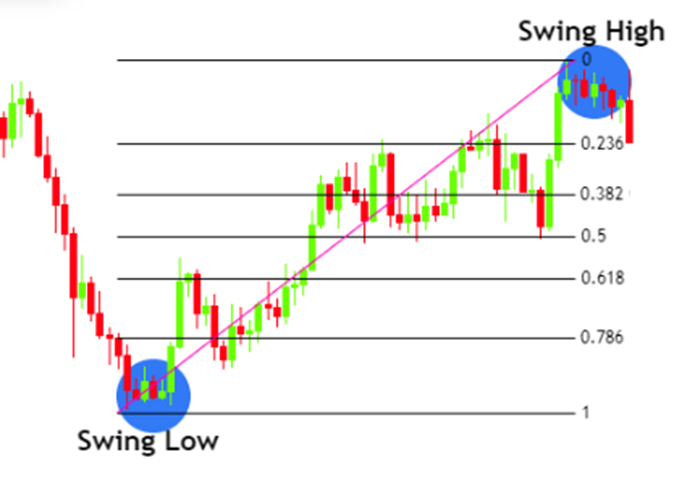

Let’s consider an example of using Fibonacci retracement levels in an uptrend:

Figure: The most recent Swing Low and Swing High on a chart.

After a brief downtrend, the market forms a Swing Low, followed by an upward movement that creates a Swing High. To plot the Fibonacci levels, you click on the Swing Low and drag to the Swing High. The Fibonacci levels appear on the chart, indicating zones where the market might reverse and continue in the uptrend.

Figure: A market finding support at the 0.618 Fibonacci level.

As shown in the chart above, the market initially tested the 0.5 level but ultimately found support at the 0.618 level, where it reversed and continued to move higher. Using Fibonacci retracements in this scenario helped traders identify a potential buying opportunity.

Fibonacci Retracements in a Downtrend

Now, let’s consider a downtrend example:

Figure: The most recent Swing High and Swing Low on a chart.

After a brief uptrend, the market forms a Swing High, followed by a downward movement that creates a Swing Low. Plotting the Fibonacci retracement levels by clicking on the Swing High and dragging to the Swing Low shows potential resistance zones where the market might reverse and continue down.

Figure: The 0.5 Fibonacci level acting as a level of resistance.

As shown in the chart, the market initially tested the 0.382 level but found resistance at the 0.5 level, where it reversed and continued to decline.

Limitations of Fibonacci Retracements

While Fibonacci retracements are powerful tools for identifying potential support and resistance levels, they are not without limitations:

- Multiple Levels: One of the main challenges is that multiple Fibonacci retracement levels exist, and any of them can act as support or resistance. This can lead to confusion, especially if the price moves past a level that a trader anticipated would hold.

- Subjectivity in Swing Points: The effectiveness of Fibonacci retracements heavily depends on identifying accurate Swing Highs and Swing Lows. Different traders may have different views on which points to use, leading to varying Fibonacci levels and interpretations.

- Not Always Reliable: Just like any technical analysis tool, Fibonacci retracement levels are not always reliable. There will be instances where the price does not respect these levels at all, making it crucial for traders to use them in conjunction with other tools and not rely on them solely.

When Fibonacci Retracements Fail

Let’s look at an example where Fibonacci retracement levels did not work as anticipated:

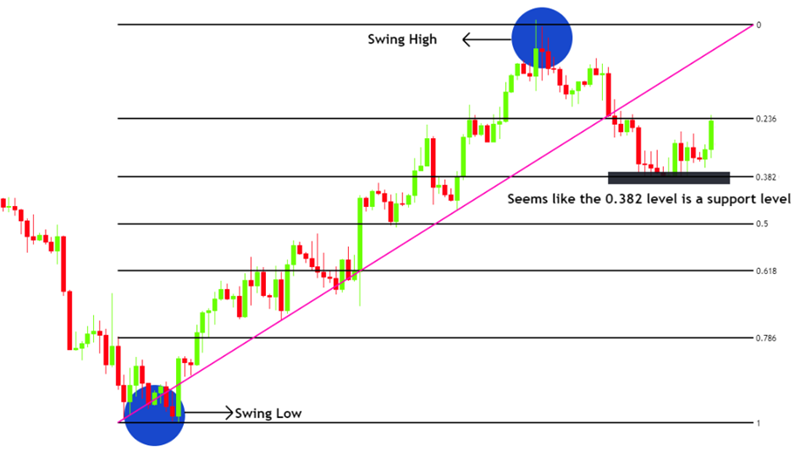

Figure: The market seems like it is finding support on the 0.382 Fibonacci level.

In the example above, the market appears to find support at the 0.382 level. Many traders might consider this a good buying opportunity. However, upon further price movement, it becomes clear that the market did not hold this level as support.

Figure: An invalidated setup; price falling even though it had brief support from a valid Fibonacci level.

As it turns out, the market broke through the 0.382 level and continued to fall, invalidating the initial setup. This scenario highlights the importance of combining Fibonacci retracements with other technical analysis tools, such as support and resistance, trendlines, moving averages, or candlestick patterns, to validate trade setups.

Enhancing Fibonacci with Other Technical Tools

To maximize the effectiveness of Fibonacci retracement levels, it is wise to use them in conjunction with other technical indicators and analysis tools. This approach can help you increase your statistical advantage in trading:

- Support and Resistance Levels: Combining Fibonacci retracement levels with historical support and resistance zones can provide more robust signals. If a Fibonacci level aligns with a strong support or resistance zone, it increases the likelihood of a price reaction.

- Moving Averages: Moving averages can help determine the overall trend direction and act as dynamic support or resistance. If a Fibonacci retracement level coincides with a moving average, it can be a strong confluence point for trade setups.

- Candlestick Patterns: Look for reversal candlestick patterns, such as dojis, hammers, or engulfing patterns, at Fibonacci retracement levels. These patterns can provide additional confirmation of a potential reversal.

- Relative Strength Index (RSI): The RSI can help identify overbought or oversold conditions. If the RSI indicates an overbought condition near a Fibonacci resistance level or an oversold condition near a Fibonacci support level, it can enhance the validity of the trade setup.

By integrating these tools, traders can develop a more comprehensive and reliable trading strategy, reducing the subjectivity and increasing the consistency of their analysis. Let’s look at some of the combinations that we just mentioned.