Do you remember how we mentioned that the Fibonacci tool becomes significantly more powerful when combined with other technical analysis tools? It’s time to dive deeper into this concept and show you exactly how you can leverage these combinations to increase your chances of trading success. By integrating Fibonacci retracement levels with additional indicators, you can create a more robust trading strategy that enhances the accuracy of your market predictions.

Fibonacci Plus Support and Resistance

Combining Fibonacci retracement levels with traditional support and resistance zones is one of the most effective methods in technical analysis. If a Fibonacci retracement level aligns with a significant support or resistance area, it can create a strong confluence zone. This alignment increases the likelihood that the price will respect that level and either reverse or experience a significant pullback.

For example, consider a downtrend scenario on a chart:

Figure: A major resistance level having a near-perfect alignment with the 0.382 Fibonacci level.

As shown in the chart, the resistance level aligns closely with the 0.382 Fibonacci retracement level. This resistance level isn’t arbitrarily drawn; it’s derived from the market’s structure. It appears that the price is likely to drop after touching this level, as evidenced by the formation of two bearish candlesticks. This setup provides a clear signal to sell, as the confluence of resistance and the Fibonacci level strengthens the potential for a price reversal. Let’s see what happened next.

Figure: Price falling after encountering a strong level of resistance.

As expected, the price dropped sharply after touching the resistance zone, yielding a substantial number of pips for traders who took the short position. This example demonstrates the power of combining Fibonacci levels with support and resistance, as it allows traders to identify high-probability trade setups.

Fibonacci Plus Trend Lines

Another powerful way to use Fibonacci retracement levels is by combining them with trend lines. Trend lines indicate the overall direction of the market and act as dynamic support or resistance. When a price tests a trend line that also aligns with a Fibonacci retracement level, it creates a strong area of value. This confluence suggests that the level is likely to hold, providing an excellent opportunity to enter a trade.

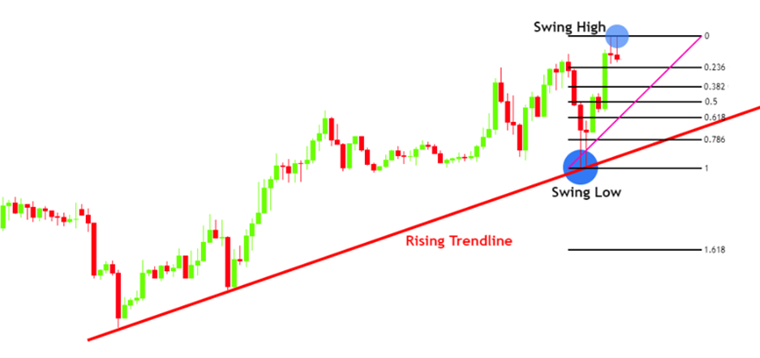

Here’s an example of an uptrend scenario:

Figure: A trendline plotted together with Fibonacci levels.

The chart above shows a market in an uptrend. According to the prevailing trend, we expect the price to pull back and test the rising trendline. If the price bounces after touching the trendline, especially at a Fibonacci retracement level, it signals a strong buying opportunity. Let’s see what happened next.

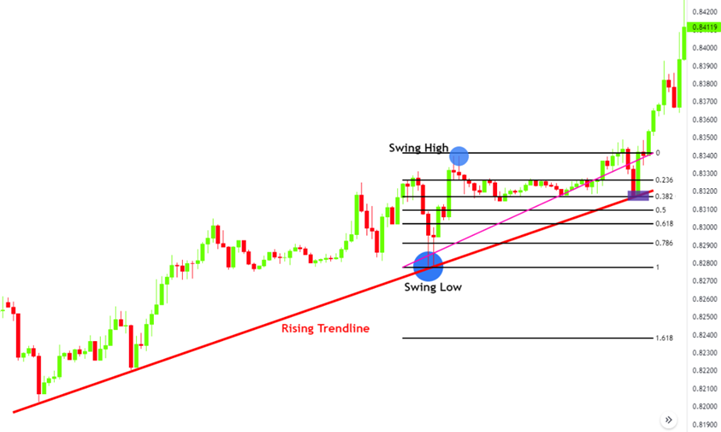

Figure: Price flying high after testing the trendline and the 0.382 Fibonacci level.

As anticipated, the price retraced to the trendline, which also aligned with the 0.382 Fibonacci level. The market then rallied strongly, confirming the bullish trend. This scenario illustrates the effectiveness of combining Fibonacci retracements with trend lines to identify robust entry points.

Fibonacci Plus Candlestick Patterns

Combining Fibonacci retracement levels with candlestick patterns is another highly effective strategy. Candlestick patterns can provide valuable insight into potential reversals and continuations in the market. When these patterns appear at significant Fibonacci levels, they can confirm the likelihood of a reversal or continuation, giving traders more confidence in their trades.

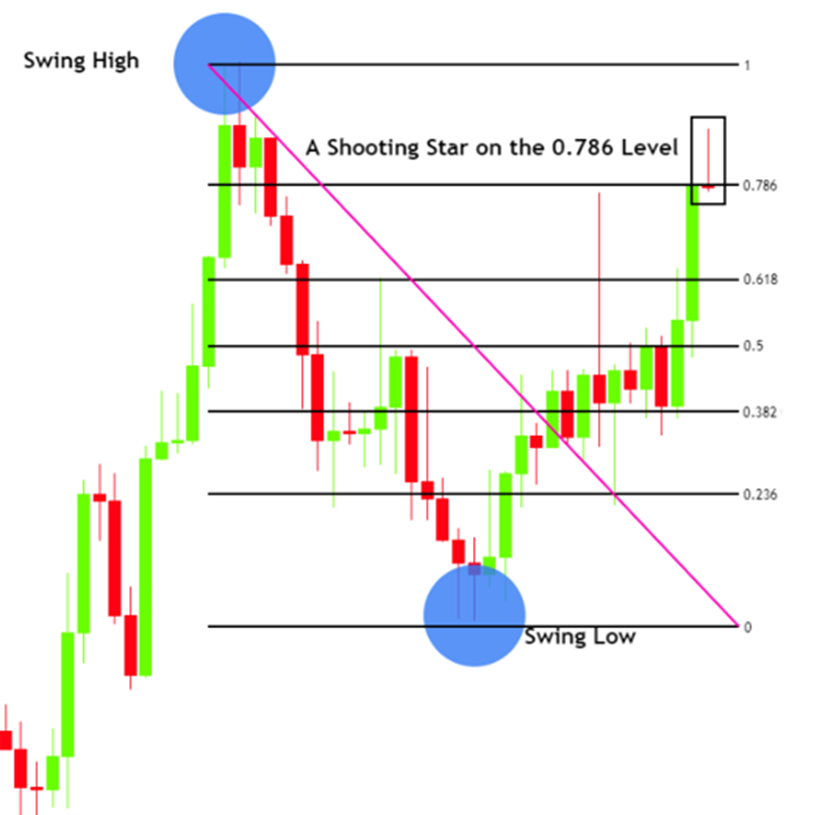

It’s essential to focus on candlesticks that signal a change in momentum when using this combination. For example, a shooting star at a Fibonacci retracement level can indicate a strong reversal to the downside.

Figure: A shooting star directly atop the 0.786 Fibonacci level.

At this point, we expect a series of bearish candlesticks, indicating a potential strong decline in price. Let’s see what happened next.

Figure: Price falling after a shooting star appeared right on the 0.786 Fibonacci level.

As anticipated, the price dropped sharply, validating the shooting star pattern and the Fibonacci level’s significance.

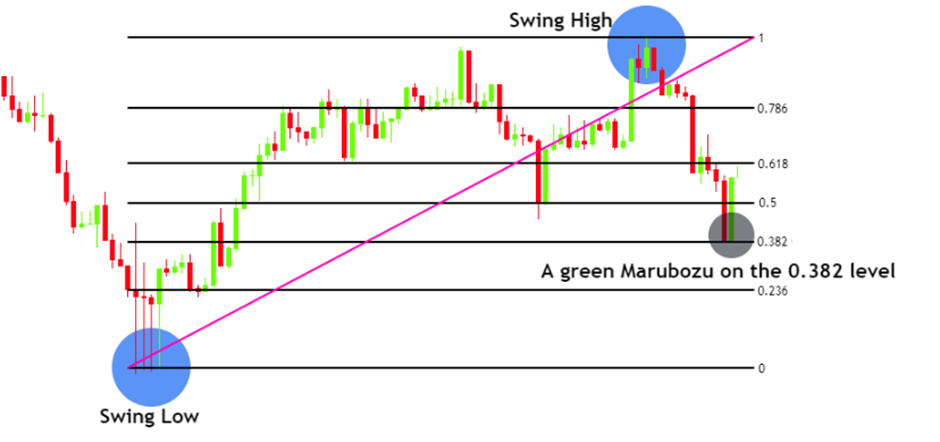

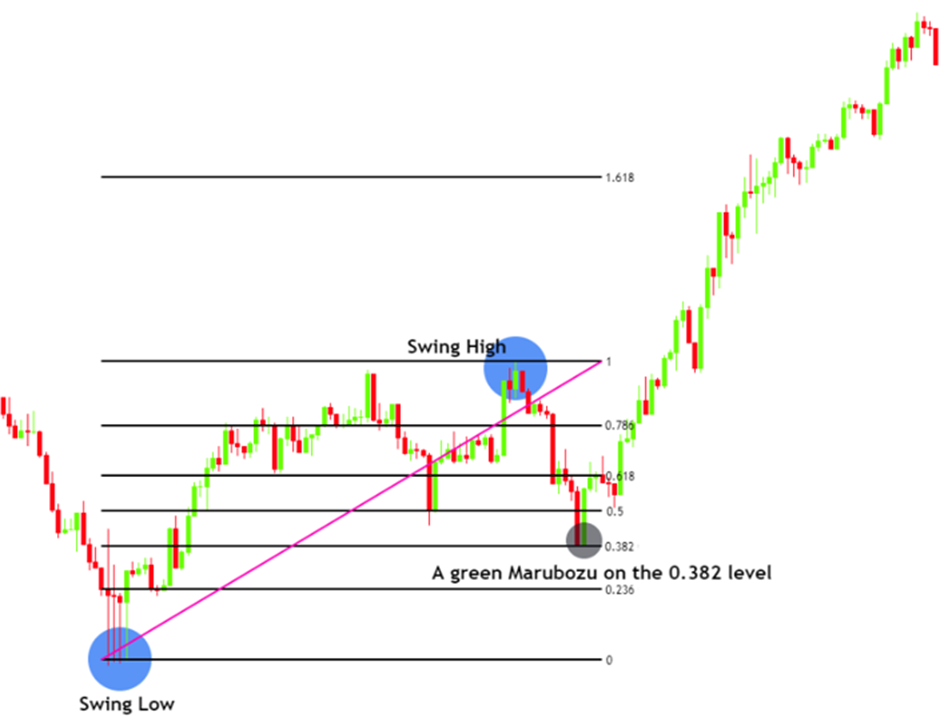

Let’s consider an example where the market reverses to the upside. In this case, a bullish candlestick pattern like a green Marubozu can indicate a potential upward reversal. If this pattern forms directly on a Fibonacci retracement level, it provides a strong signal to buy.

Figure: A green Marubozu directly on top of the 0.382 Fibonacci level.

The appearance of a green Marubozu at the 0.382 Fibonacci level indicates potential support and a move to the upside. With this confluence, a long position is justified. Let’s see what happened next.

Figure: Price shooting up after the green Marubozu found support from the 0.382 Fibonacci level.

The price surged upward, confirming the bullish signal provided by the Marubozu and the Fibonacci level.

By now, you should have a clearer understanding of how combining Fibonacci retracement levels with other technical analysis tools can create a more robust trading strategy. These combinations increase the statistical probability of successful trades by confirming signals and reducing the risk of false positives.

However, it’s crucial to remember that no trading strategy is foolproof. Market conditions are always changing, and unexpected news or events can impact the outcome of trades. Therefore, it’s essential to use proper risk management and never rely solely on one indicator or tool.

Fibonacci retracement levels, when combined with support and resistance, trend lines, and candlestick patterns, offer a comprehensive approach to trading. By mastering these combinations and continuously honing your skills, you’ll be well on your way to becoming a more confident and successful trader. Remember, the market presents opportunities regularly, but it’s up to you to recognize them and execute your strategy effectively.