Fibonacci extension levels are an essential tool for traders, helping them set profit targets and manage their risk effectively. These levels are particularly useful in determining how far the price might move after a pullback or correction within a trend. Unlike Fibonacci retracement levels, which help traders identify potential reversal points, Fibonacci extension levels project where the price might go following the continuation of the primary trend. By using these extension levels, traders can identify potential areas to take profits or set stop losses, thereby optimizing their trading strategy.

Understanding Fibonacci Extension Levels

Fibonacci extension levels are calculated using the same ratios as Fibonacci retracement levels, with the most commonly used extension levels being 0.382, 0.50, 0.618, and 0.786. These levels indicate possible price extensions beyond the original trend direction, giving traders insights into where the price might head next.

Plotting Fibonacci Extension Levels on Your Chart

To plot Fibonacci extension levels, you need to identify the current market trend and the major swing points. In an uptrend, follow these steps:

- Identify the Major Swing Low: Start by clicking on the most significant low point, which represents the beginning of the move.

- Mark the Recent Swing High: Drag the cursor from the swing low to the most recent swing high and click to confirm this level.

- Select the Retracement Level: Finally, drag the cursor back down to any of the retracement levels and click to establish the Fibonacci extension levels.

Example: Uptrend Fibonacci Extension Levels

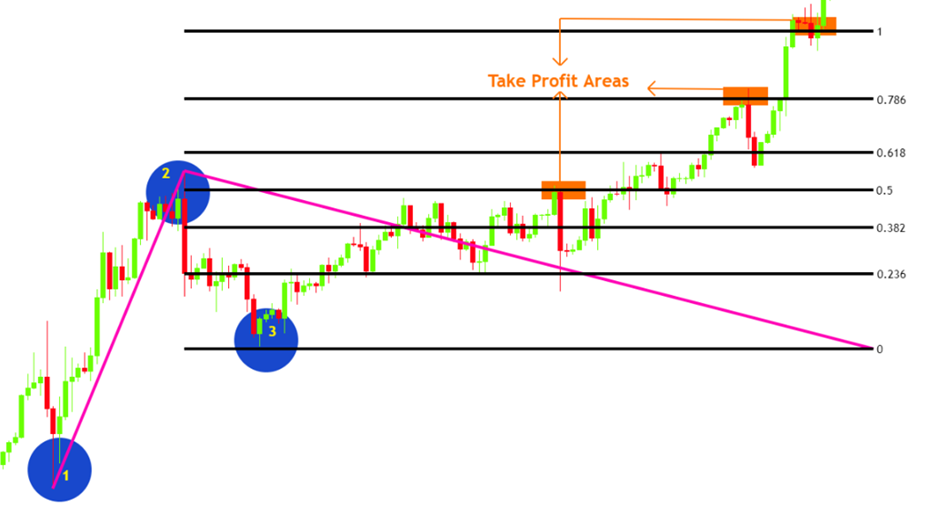

Figure: A ‘3-click process’ for plotting Fibonacci extension levels in an upward-moving market.

The numbered steps on the chart illustrate where to click to plot the Fibonacci extension levels. The highlighted orange areas indicate potential profit-taking zones. These areas are ideal for taking profits because they align precisely with the Fibonacci extension levels and coincide with price deceleration, indicating potential reversals or pullbacks.

When you see price slowing down or showing signs of reversal at these levels, it’s a good opportunity to secure your profits. However, if the price continues to move beyond the extension level without signs of slowing down, you can hold your position and wait for the next extension level. This ‘observation process’ allows traders to maximize their gains while minimizing the risk of a reversal.

Applying Fibonacci Extension Levels in a Downtrend

In a downtrend, the process is similar but reversed:

- Identify the Major Swing High: Start by clicking on the highest point, representing the beginning of the move.

- Mark the Recent Swing Low: Drag the cursor from the swing high to the most recent swing low and click to confirm this level.

- Select the Retracement Level: Drag the cursor up to any of the retracement levels and click to establish the Fibonacci extension levels.

Example: Downtrend Fibonacci Extension Levels

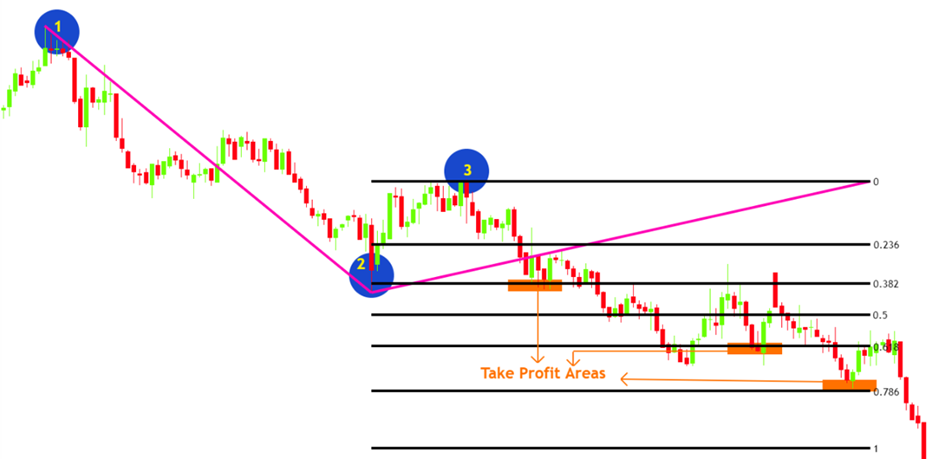

Figure: A ‘3-click process’ for plotting Fibonacci extension levels in a downward-moving market.

Just as in an uptrend, the orange areas mark potential profit-taking zones because they correspond to the Fibonacci extension levels, where price shows signs of rejection or reversal.

Dual Functionality: Setting Stop Losses with Fibonacci Extension Levels

Fibonacci extension levels are versatile, serving a dual purpose: they help set both profit targets and stop losses. Knowing when to cut losses short is just as important as knowing where to take profits. This tool provides a structured approach to managing risk, ensuring that your capital is protected if the market moves against your position.

Placing Stops with Fibonacci Extension Levels

There are several strategies for setting stop losses using Fibonacci extension levels, but one of the most effective methods involves placing stops slightly beyond the next Fibonacci level. This approach provides a buffer zone, allowing some price fluctuation while protecting against significant losses.

For instance, consider a market in a downtrend:

- Identify Swing Points: As the market pulls back, identify a major swing high and a swing low.

- Determine Entry and Stop Loss: If you decide to go short (sell) at the 50% (0.50) Fibonacci level based on your analysis, you would place your stop loss just beyond the next level, the 61.8% (0.618) Fibonacci level. This placement provides a cushion if the price briefly moves against you, minimizing potential losses.

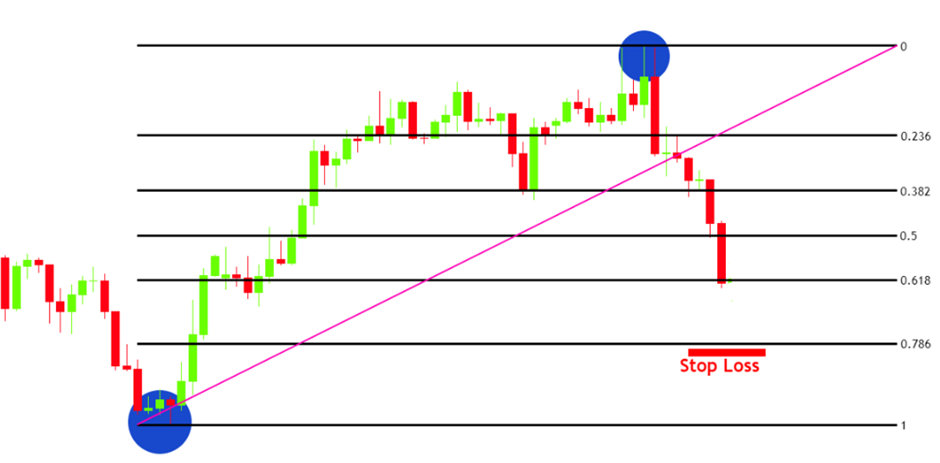

Example: Setting Stops in a Downtrend

Figure: Setting stops using the Fibonacci extension levels tool for a market in a downtrend.

In an uptrend, the same principle applies but in the opposite direction. If you expect the 0.618 Fibonacci level to act as support and decide to go long (buy), you would place your stop loss slightly below the 0.786 Fibonacci level. This approach allows for minor price fluctuations while safeguarding your position against a significant downturn.

Example: Setting Stops in an Uptrend

Figure: Setting stops using the Fibonacci extension levels tool for a market in an uptrend.

By integrating Fibonacci extension levels into your trading strategy, you can enhance your ability to set precise profit targets and manage risk effectively. This tool, when used correctly, can significantly improve your trading edge by providing clear guidelines on where to take profits and place stop losses.

Remember, trading is not just about identifying opportunities but also about protecting your capital. The Fibonacci extension tool helps you achieve both. With practice and careful observation, you can master this tool and use it to make more informed trading decisions. As with any trading strategy, always apply proper risk management and be prepared for market volatility. The market is dynamic, and while Fibonacci extension levels provide valuable insights, no tool is infallible. Stay vigilant, continue learning, and refine your strategy to adapt to changing market conditions.