Moving averages (MAs) are one of the most used technical indicators in trading. They provide a simplified view of the price movement over a specified period by filtering out short-term fluctuations and highlighting the underlying trend. By calculating the average price over a set timeframe, moving averages create a continuous line on a chart that helps traders identify the direction and strength of a trend. This tool is essential for making informed trading decisions and is used in various trading strategies.

What is a Moving Average?

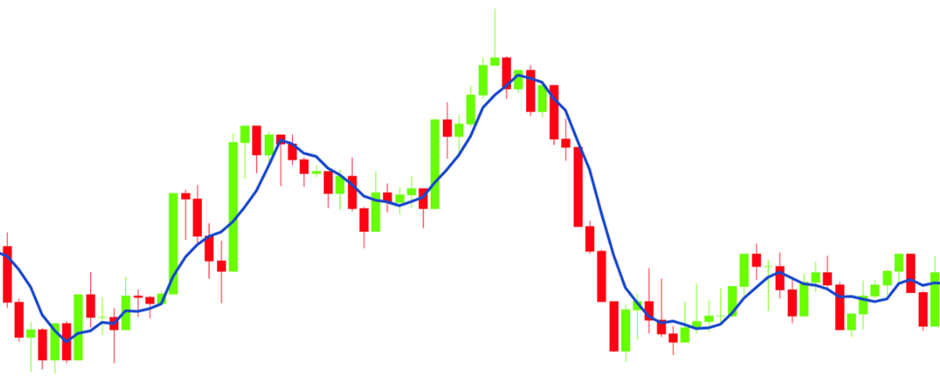

A moving average represents the average price of an asset over a specific period. By calculating this average, moving averages smooth out the noise created by random price movements, providing a clearer picture of the overall trend. The appearance of a moving average on a chart depends on the time frame chosen for the calculation. Shorter time frames will result in more responsive moving averages that react quickly to price changes, often appearing “rough” or choppy. Conversely, longer time frames produce “smoother” moving averages that are slower to react, giving a more stable view of the trend.

There are four main types of moving averages: Simple (Arithmetic), Exponential, Smoothed, and Weighted. Each type of moving average has its unique characteristics and use cases. In this section, we will focus on the two most popular types: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

Simple Moving Averages (SMAs)

A Simple Moving Average (SMA) is calculated by summing the prices of an asset over a specific period and then dividing by the number of periods. The SMA can be applied to various price points, such as the opening, closing, highest, or lowest prices, but it is most used with closing prices.

For example, a 20-period SMA on a daily chart calculates the average closing price of the asset over the past 20 days. If you were to calculate an SMA using the opening prices, you would add up the opening prices of the last 20 days and divide by 20 to get the average.

Most charting software automatically calculates these averages for you, making it easy to apply SMAs to any time frame and price point. It is important to understand how to adjust the settings of the SMA, such as changing the time frame or selecting a different price point, to suit your trading strategy.

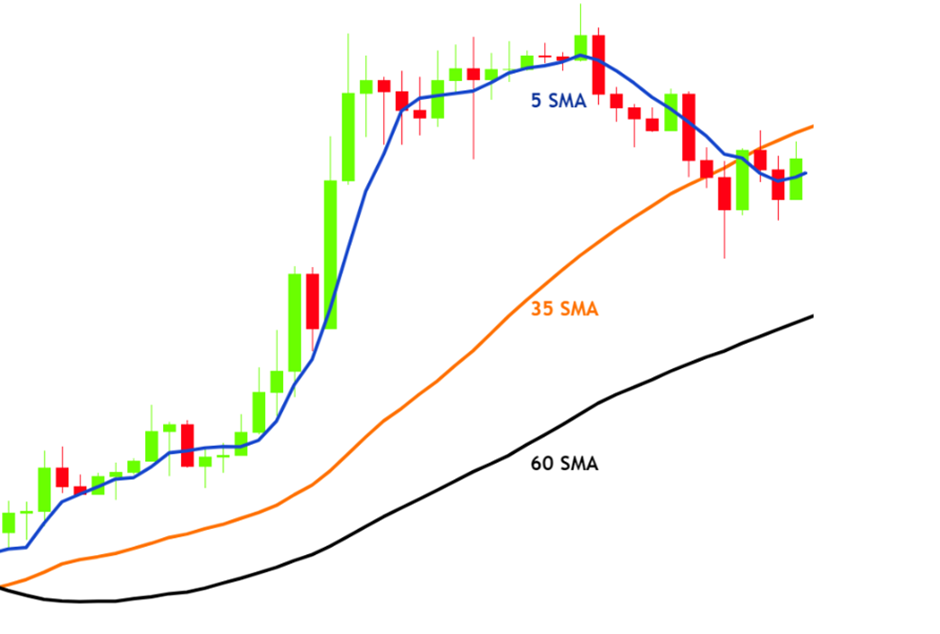

Example: Plotting Multiple SMAs on a Chart

Figure: Plotting multiple moving averages on a chart.

In the chart above, we can see different SMAs plotted over various time frames. Notice how the shorter-period SMA (5 SMA) stays closer to the price action, reacting more quickly to price changes. In contrast, the longer-period SMA (60 SMA) lags behind the price, providing a smoother line that reflects the broader trend. This difference in responsiveness is crucial for traders to understand, as it affects how moving averages can be used to identify trends and make trading decisions.

SMAs are particularly useful in determining the direction of the market. When the SMA is moving upwards, it indicates an uptrend, while a downward-moving SMA suggests a downtrend. If the SMA is relatively flat, the market is likely ranging or moving sideways. By observing the slope and position of the SMA relative to the price, traders can gain insights into market conditions and adjust their strategies accordingly.

Exponential Moving Averages (EMAs)

An Exponential Moving Average (EMA) gives more weight to the most recent prices, making it more responsive to new information than the SMA. This weighting makes the EMA more sensitive to recent price movements, which can be beneficial in fast-moving markets or when trading assets that exhibit high volatility. Like the SMA, the EMA can be applied to various price points, such as the opening, closing, highest, or lowest prices.

The calculation of the EMA involves a more complex formula than the SMA, incorporating a smoothing factor that determines the weight given to the most recent prices. This results in the EMA reacting more quickly to price changes, providing traders with timely signals that can be crucial in capturing short-term opportunities.

Example: Comparing SMAs and EMAs

Figure: Plotting different moving averages on the same chart.

In the chart above, we compare a 50-period SMA and a 50-period EMA. Notice how the 50 EMA stays closer to the price action, reflecting its responsiveness to recent price movements. This characteristic makes the EMA a valuable tool for traders looking to identify short-term trends and reversals.

Choosing Between SMAs and EMAs

Deciding whether to use an SMA or an EMA depends on your trading style and objectives. Both types of moving averages have their advantages and disadvantages:

- Simple Moving Averages (SMA): SMAs are useful for identifying the overall trend of the market and are less prone to false signals due to their slower reaction to price changes. This characteristic makes SMAs ideal for long-term traders who want to avoid the noise of short-term price fluctuations. However, the lag in SMAs can also mean that they may miss early signals of trend reversals or new trends, potentially resulting in fewer captured pips or profits.

- Exponential Moving Averages (EMA): EMAs are more sensitive to recent price changes, making them suitable for traders who want to capture short-term market movements. The quick reaction of EMAs allows traders to spot potential trend reversals or pullbacks faster, which can be advantageous in volatile markets. However, this sensitivity also means that EMAs are more susceptible to false signals and may result in more frequent trades, some of which may not be profitable.