We now look at some ways we use moving averages in trading.

Using Moving Averages to Identify Trends

Moving averages (MAs) are versatile tools in technical analysis, and traders often incorporate them into various strategies to enhance their decision-making process. One fundamental way to use moving averages is as a trend confirmation tool. By analyzing the position and slope of moving averages in relation to price action, traders can gain insights into the prevailing market trend and make informed trading decisions.

Identifying Trends with Moving Averages

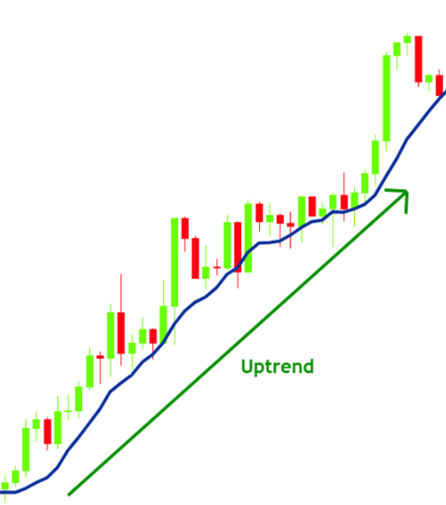

- Uptrend Confirmation: When a moving average is positioned below the price action and has a positive slope, it suggests that the market is in an uptrend. The moving average acts as a dynamic support level, indicating that the prices are generally trending upwards. In an uptrend, traders look for buying opportunities, expecting the price to continue moving higher.

Figure: Uptrend confirmation using a moving average.

- Downtrend Confirmation: Conversely, when a moving average is above the price action and has a negative slope, it signals a downtrend. In this scenario, the moving average acts as a dynamic resistance level, showing that the prices are trending downward. During a downtrend, traders often look for selling opportunities, anticipating further declines in price.

Figure: Downtrend confirmation using a moving average.

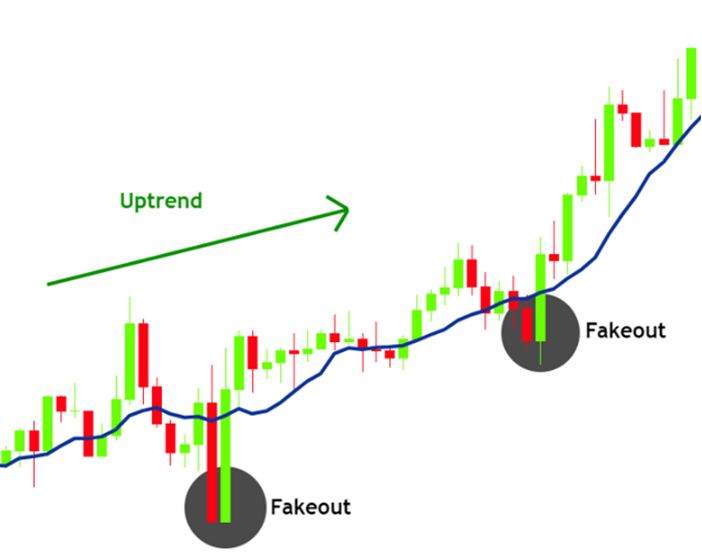

However, it’s important to note that price movements can sometimes breach a moving average, leading to what are known as “fake breakouts” or “fakeouts.” These are false signals where the price appears to break through a moving average but quickly reverses, trapping traders on the wrong side of the market.

Figure: A chart showing false breakouts (fakeouts).

Filtering Out Fakeouts with Multiple Moving Averages

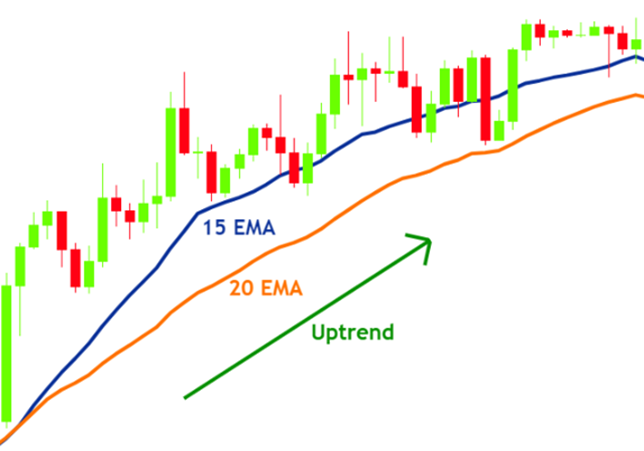

To minimize the impact of fakeouts and obtain a more reliable indication of the market trend, many traders use multiple moving averages on a single chart. By analyzing the relationship between different moving averages, traders can confirm trends more accurately.

Figure: Filtering out fakeouts with multiple moving averages.

- Using Multiple Moving Averages for Trend Confirmation: When multiple moving averages are plotted on a chart, they can provide a clearer picture of the trend. In an uptrend, the shorter-period moving average (which is more responsive to price changes) should be above the longer-period moving average. This alignment indicates that the recent price action is stronger than the historical price action, confirming the upward trend.

Figure: Uptrend confirmation using multiple moving averages.

In a downtrend, the opposite is true—the shorter-period moving average should be below the longer-period moving average. This setup indicates that recent prices are lower than historical prices, confirming a downward trend.

Figure: Downtrend confirmation using multiple moving averages.

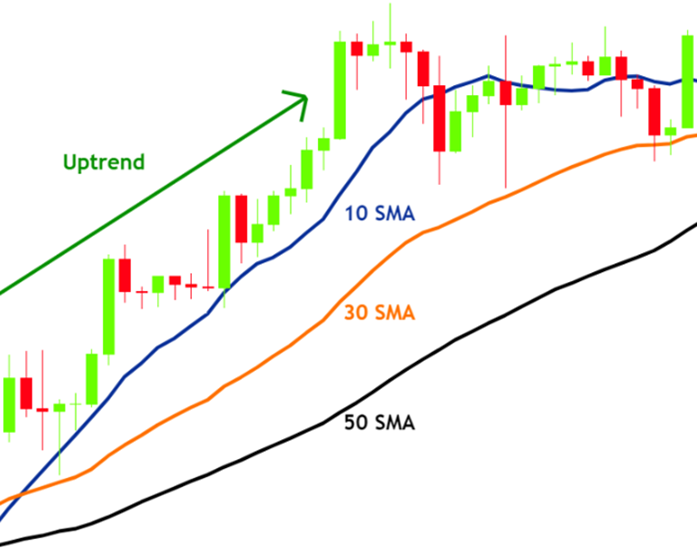

Traders are not limited to using only two moving averages; they can use several to further refine their analysis. When using more than two moving averages, for a valid uptrend, the moving averages should line up in order, with faster (shorter-period) moving averages above slower (longer-period) ones. The reverse holds for a downtrend.

Figure: Trend confirmation using multiple moving averages.

Moving Average Crossovers

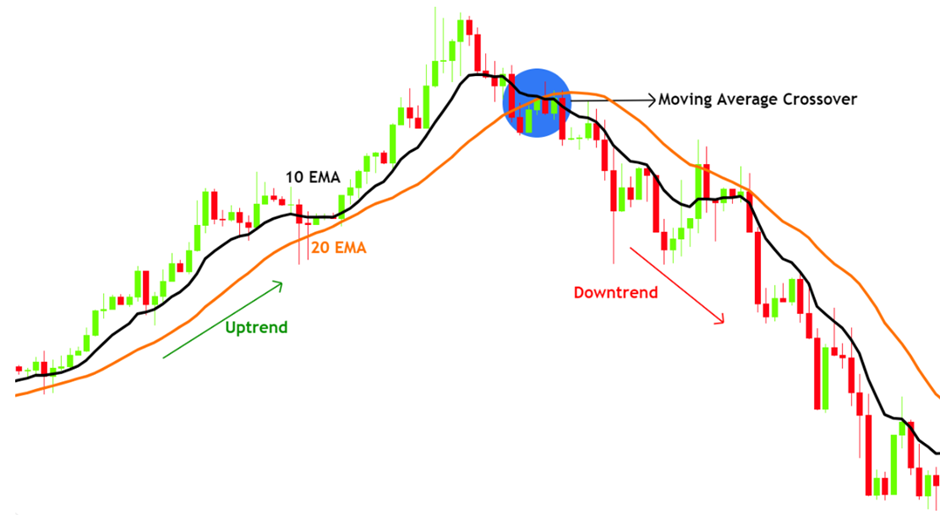

Another powerful method to use moving averages is to identify potential trend reversals through moving average crossovers. A crossover occurs when two moving averages of different periods intersect, signaling a potential change in the trend.

- Bullish Crossover: In an uptrend, a bullish crossover occurs when a shorter-period moving average crosses above a longer-period moving average. This crossover suggests that the upward momentum is gaining strength, and a new uptrend may be forming.

- Bearish Crossover: Conversely, in a downtrend, a bearish crossover occurs when a shorter-period moving average crosses below a longer-period moving average. This crossover indicates that downward momentum is increasing, suggesting a potential downtrend.

Figure: When moving averages crossover.

The chart above illustrates a typical moving average crossover scenario. After the crossover, the market reversed its direction, highlighting how crossovers can signal a shift in trend.

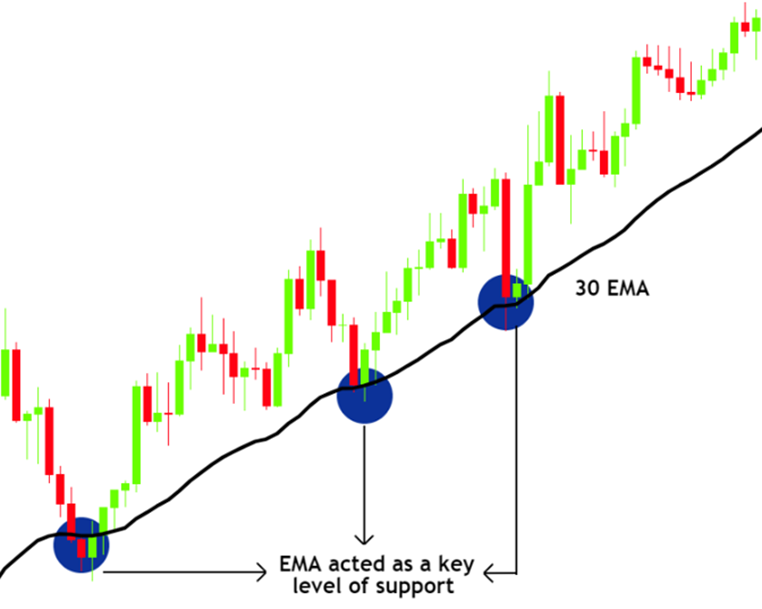

Moving Averages as Dynamic Support and Resistance

Moving averages can also serve as dynamic support and resistance levels, fluctuating with the price rather than remaining static like traditional horizontal support and resistance lines.

- Dynamic Support: In an uptrend, moving averages can act as dynamic support levels. When the price pulls back to the moving average and bounces off, it suggests that the moving average is supporting the price, reinforcing the uptrend. Traders might look for buying opportunities near the moving average.

Figure: Moving average acting as a support level.

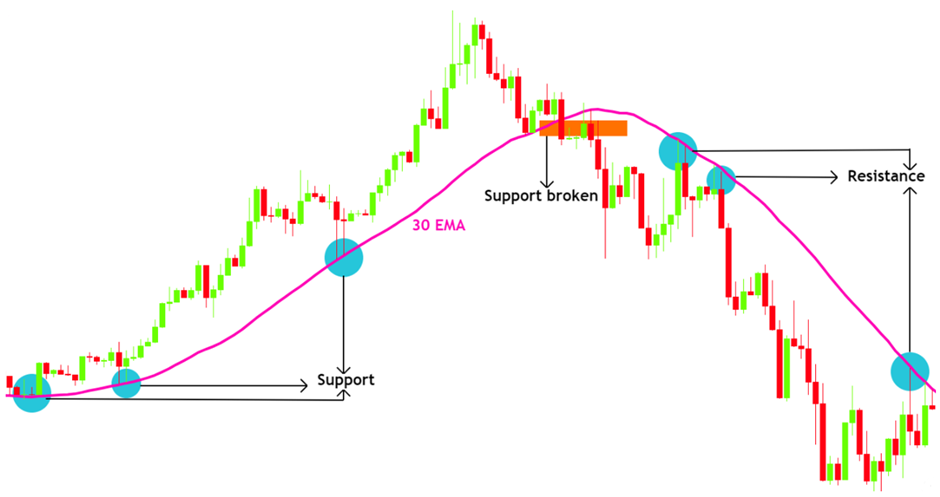

- Dynamic Resistance: In a downtrend, moving averages can act as dynamic resistance levels. When the price rises to the moving average and then drops, it indicates that the moving average is resisting the price, reinforcing the downtrend. Traders might look for selling opportunities near the moving average.

Just like traditional support and resistance, price does not always bounce perfectly off dynamic support and resistance levels. Sometimes, the price may slightly pass these areas before reversing, which is why it’s often useful to plot “zones” rather than precise lines.

Figure: The “zone” acting as resistance.

To create these zones, traders can plot two moving averages and consider the space between them as the buy or sell zone, depending on the trend. For instance, in an uptrend, the area between a shorter-period and a longer-period moving average can serve as a buy zone. In a downtrend, the space between them can act as a sell zone.

Additionally, similar to traditional horizontal support and resistance, when a dynamic support (moving average) is broken, it often turns into a dynamic resistance. Likewise, when a dynamic resistance is broken, it typically becomes a dynamic support.

Figure: Dynamic support turning into resistance.

Moving averages are invaluable tools for traders, offering insights into trend direction, potential reversals, and dynamic support and resistance levels. By understanding how to use moving averages effectively, traders can enhance their ability to navigate the markets, make better trading decisions, and improve their overall trading performance. Whether used for confirming trends, identifying reversals, or spotting dynamic support and resistance, moving averages are versatile indicators that can be tailored to suit any trading strategy.