The Parabolic SAR (Stop and Reverse) is a popular technical analysis tool developed by J. Welles Wilder. It is widely used by traders to determine the direction of an asset’s trend and to pinpoint potential entry and exit points. The simplicity of the Parabolic SAR makes it an excellent choice for traders at all experience levels.

Understanding the Parabolic SAR

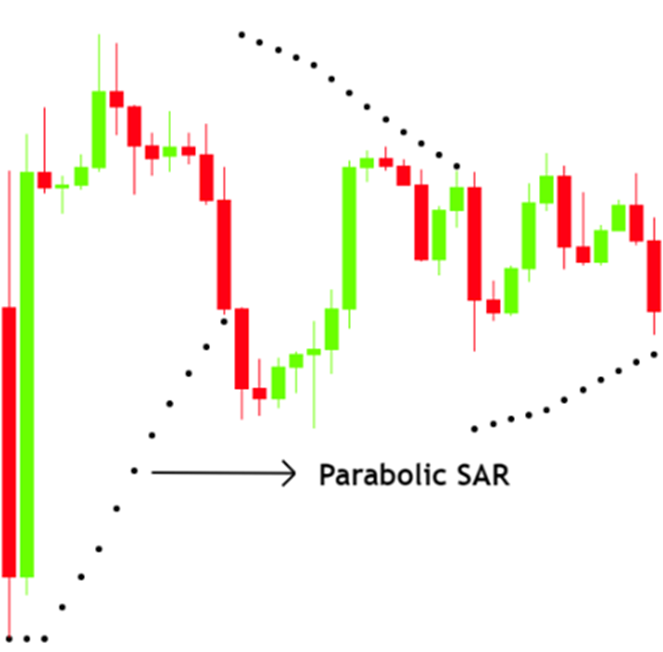

The Parabolic SAR is represented on a chart as a series of dots placed either above or below the price bars. These dots indicate potential points of reversal in the price direction:

- Dots Above Price Action: When the dots appear above the price, it suggests that the market is in a downtrend. This signals traders to either stay out of long positions or consider entering short positions.

- Dots Below Price Action: When the dots are below the price, it indicates an uptrend. This signals traders to consider staying in or entering long positions and to avoid shorting the market.

Figure: Parabolic SAR on a chart.

How to Use the Parabolic SAR for Trading

The Parabolic SAR is primarily used for identifying trends and finding optimal points to enter and exit trades. Here’s how you can effectively use it:

- Identifying Trend Direction: The most straightforward use of the Parabolic SAR is to determine the current trend. By observing the position of the dots relative to the price action, you can quickly ascertain whether the market is trending upwards or downwards.

- Determining Entry Points: In an uptrend, traders can use the Parabolic SAR to time their entry points. When the dots switch from being above the price to below it, this can be a signal to enter a long position. Conversely, in a downtrend, when the dots move from below the price to above it, it can signal a good time to enter a short position.

- Setting Stop-Losses: One of the unique features of the Parabolic SAR is its ability to help traders set dynamic stop-loss levels. The dots can be used as a trailing stop that moves with the price. For example, in an uptrend, traders can set their stop-loss just below the dots. If the trend reverses and the dots move above the price, the position can be closed automatically, minimizing losses.

- Exiting Trades: The Parabolic SAR is particularly useful for determining exit points. If you are in a long position and the dots shift from below to above the price, this indicates a potential trend reversal, and it may be time to exit the trade. Similarly, in a short position, if the dots move from above to below the price, this could signal an exit point.

Parabolic SAR Strategy: The Five-Dot Rule

A common challenge with using the Parabolic SAR is determining how many dots it takes to confirm a true trend reversal. To manage this, we recommend the Five-Dot Rule:

- In an Uptrend: If you notice that dots have started forming above the price, wait for five consecutive dots before considering it a confirmed trend reversal. This reduces the likelihood of being caught by a temporary pullback or “breathing” of the market, which could prematurely trigger an exit.

- In a Downtrend: Similarly, if the market is in a downtrend and dots begin to appear below the price, wait for five consecutive dots to confirm the potential shift in trend.

While some traders might use a three-dot confirmation for faster signals, this approach can lead to false reversals due to market noise. The Five-Dot Rule provides a stronger confirmation, ensuring that you are not exiting a position prematurely due to short-term price fluctuations.

Figure: Trading using the Parabolic SAR.

Additional Tips for Using the Parabolic SAR

- Avoiding Choppy Markets: The Parabolic SAR is most effective in trending markets and can produce false signals during periods of consolidation or sideways price action. To avoid being whipsawed in a range-bound market, it’s often wise to use the Parabolic SAR in conjunction with other indicators, such as moving averages or the Average Directional Index (ADX), which can help confirm the strength of a trend.

- Adjusting the SAR Settings: The default settings for the Parabolic SAR are typically suitable for most markets, but they can be adjusted to better suit different timeframes or trading styles. Increasing the step value can make the SAR more sensitive, which is useful for capturing shorter-term trends. Conversely, decreasing the step value can make the SAR less sensitive, which is ideal for filtering out market noise in longer-term trends.

- Combining with Other Indicators: The Parabolic SAR works best when used alongside other technical indicators. For example, combining the SAR with the Relative Strength Index (RSI) can help confirm entry and exit points. If the RSI shows that the market is overbought while the SAR indicates a downtrend, this could provide a stronger sell signal.

The Parabolic SAR is a powerful yet simple tool that can greatly enhance your trading strategy. By helping you identify trends and providing clear entry and exit points, it can be an invaluable addition to your trading arsenal. Remember, while the Parabolic SAR is effective on its own, combining it with other technical indicators and using it in the appropriate market conditions can significantly improve your trading results. As with any tool, practice and experience will help you get the most out of the Parabolic SAR and make it work for your unique trading style.