The Average Directional Index (ADX) is a powerful technical analysis tool that helps traders assess the strength of a trend, regardless of its direction. Unlike other indicators that focus on price movement or momentum, the ADX is specifically designed to measure the strength of a trend, providing valuable insights into whether the market is trending or ranging.

Understanding ADX Values:

The ADX is plotted on a scale from 0 to 100:

- Below 20: Readings below 20 indicate a weak trend or a ranging market. In such conditions, price movements are typically sideways, and significant trends are unlikely to develop. Traders might find fewer opportunities during these periods, as the market lacks clear directional movement.

- 20 to 50: When the ADX is between 20 and 50, it suggests that a trend is gaining strength. The higher the ADX value, the stronger the trend. This is where traders start to look for potential breakout opportunities or consider riding the trend.

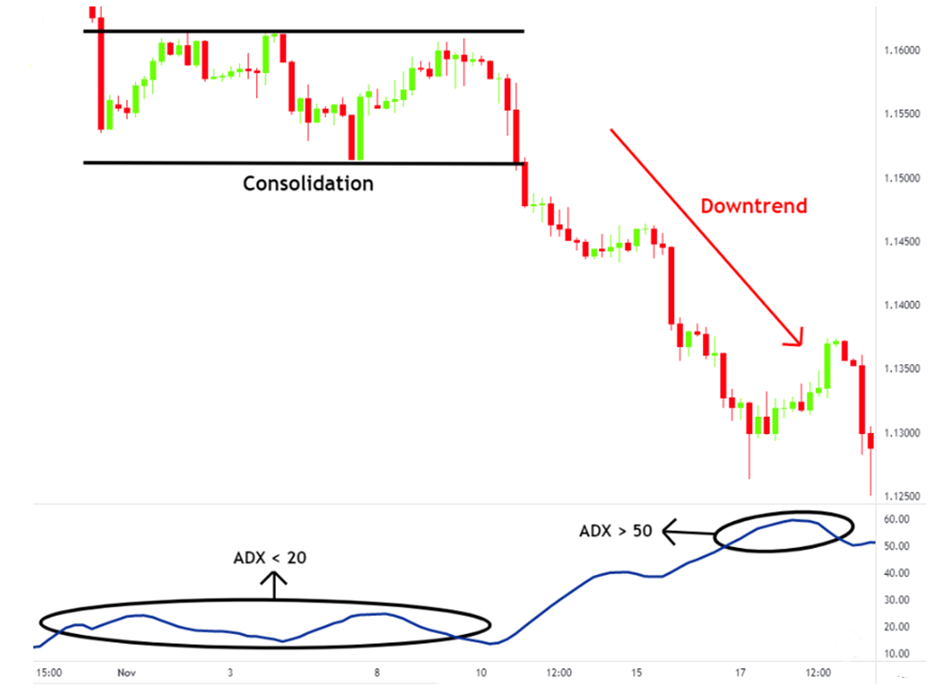

- Above 50: Readings above 50 indicate a strong trend, whether it’s an uptrend or a downtrend. In these scenarios, the market is showing significant directional movement, and traders can capitalize on the momentum. However, it’s also important to remain vigilant, as trends can exhaust themselves after a period of strong movement.

Figure: ADX values and trend strength.

Using ADX for Trading Decisions:

The ADX is not only useful for identifying strong trends but also for filtering out false signals, making it an essential tool for managing risk and improving trade accuracy.

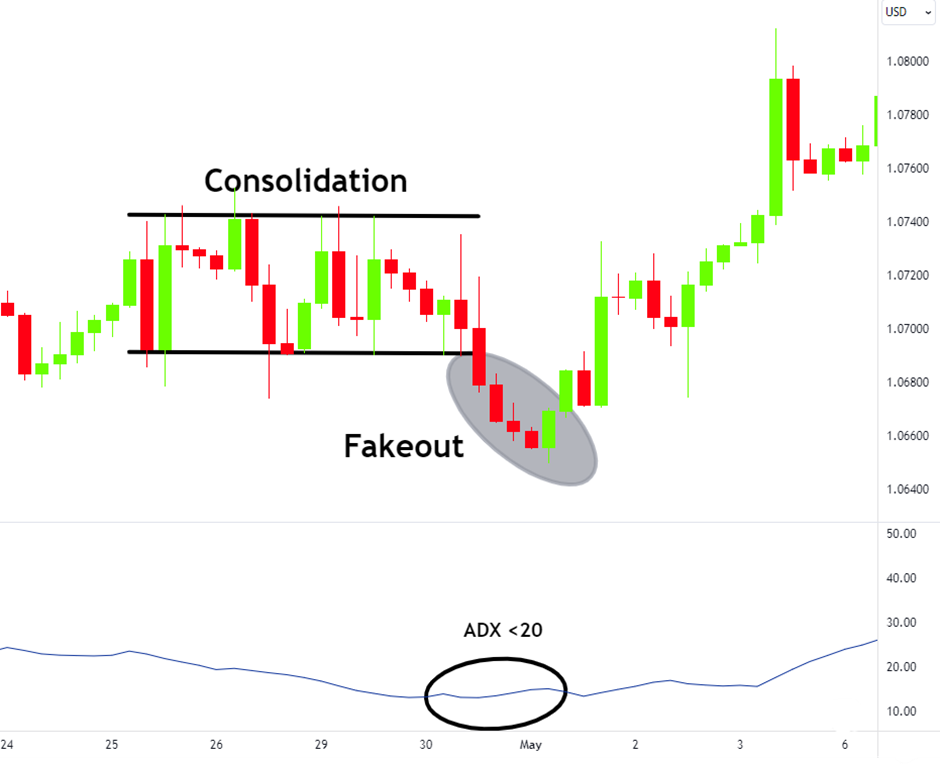

- Filtering Fakeouts: One of the key advantages of the ADX is its ability to filter out fakeouts, especially after periods of consolidation. For instance, if a breakout occurs but the ADX remains below 20, it’s likely a fakeout, and the breakout may not lead to a sustained trend. On the other hand, if the ADX rises above 20 and continues to increase, it confirms that a new trend is likely forming, providing a more reliable trading signal.

Figure: ADX filtering a fakeout.

- Confirming Breakouts: When the ADX crosses above 20 after a period of consolidation, it signals the potential start of a new trend. This is particularly useful for traders who want to catch early trends. A rising ADX following a breakout suggests that the market is likely to continue in the breakout direction, giving traders more confidence in their trades.

Figure: ADX confirming a breakout.

ADX as an Exit Indicator:

The ADX is also a valuable tool for determining exit points in a trade. Once you’re in a trade and the ADX reaches high levels (e.g., above 50), you might want to closely monitor it for signs of weakening:

- Declining ADX: If the ADX begins to fall from a high level, it may indicate that the trend is losing momentum. This can be a signal to start thinking about exiting your trade, as the strength of the trend is diminishing. Taking profits at this stage can help you avoid getting caught in a potential reversal or a period of consolidation.

Combining ADX with Other Indicators:

To maximize the effectiveness of the ADX, it can be combined with other indicators that provide information about trend direction or momentum:

- ADX + Moving Averages: Pairing the ADX with moving averages can help traders not only gauge trend strength but also confirm the direction. For example, if the ADX is rising above 20 and the price is above a key moving average, it can provide a stronger signal to go long.

- ADX + RSI/Stochastic: While the ADX tells you about trend strength, indicators like the RSI or Stochastic can help identify overbought or oversold conditions. Using them together allows traders to enter trades with the trend while avoiding overextended markets.

ADX Settings and Customization:

The standard period setting for the ADX is 14 periods, but like other indicators, it can be adjusted depending on the trader’s strategy and the market being analyzed:

- Shorter Periods (e.g., 7 periods): A shorter period setting will make the ADX more responsive, which can be useful in fast-moving markets or for short-term trading. However, this may also increase the number of false signals.

- Longer Periods (e.g., 21 periods): A longer period setting smooths out the ADX, making it more reliable for identifying strong trends over longer time frames. This setting is often preferred by swing traders or those trading on higher time frames.

The ADX is an essential tool for traders who want to understand the strength of market trends. Whether you’re identifying the best times to enter or exit trades, filtering out fakeouts, or confirming the continuation of a trend, the ADX provides critical insights that can significantly enhance your trading strategy. By integrating the ADX with other technical indicators and paying attention to its readings, traders can make more informed decisions and improve their overall market performance.